Does USAA bundle insurance? This introduction delves into the concept of bundled insurance, highlighting the various benefits and types of insurance policies that can be combined for cost savings and convenience.

Exploring how bundling insurance with USAA works and the potential discounts and special offers available for policyholders.

Does USAA Offer Bundled Insurance Packages?: Does Usaa Bundle Insurance

When it comes to insurance, bundling is a common practice that involves combining multiple insurance policies from the same provider. USAA does offer bundled insurance packages, allowing customers to streamline their insurance needs and potentially save money in the process.

Concept of Bundled Insurance

Bundled insurance refers to the practice of purchasing multiple insurance policies, such as auto, home, and life insurance, from a single provider. By bundling policies together, customers can often receive discounts and benefits that they wouldn’t get if they purchased each policy separately.

Examples of Bundled Insurance Types, Does usaa bundle insurance

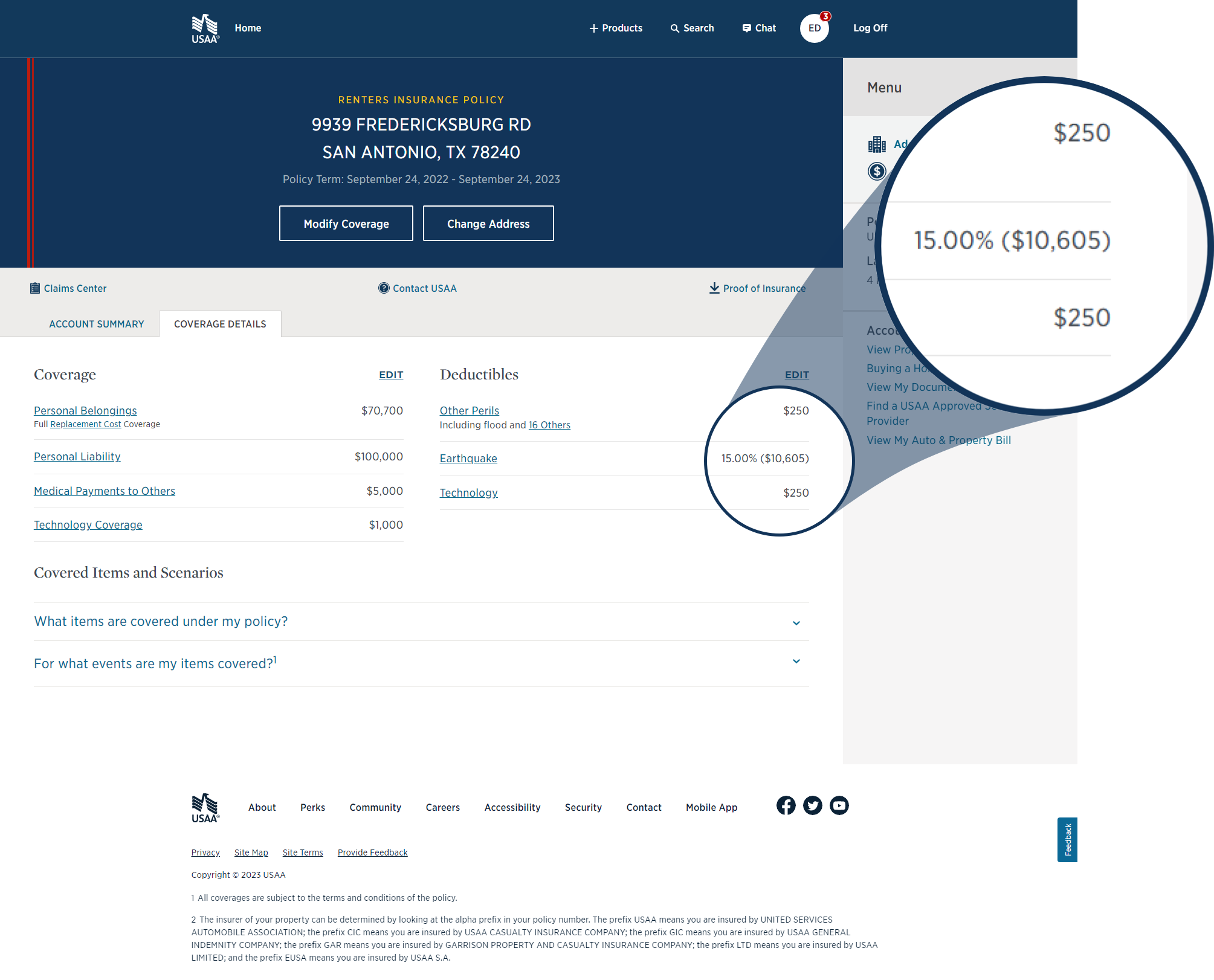

Some examples of insurance that can be bundled together with USAA include auto and home insurance, renter’s and auto insurance, or life and auto insurance. By combining these policies, customers can enjoy convenience and cost savings.

Potential Benefits of Bundling Insurance Policies

The potential benefits of bundling insurance policies with USAA include cost savings, simplified billing, and the convenience of having all policies under one provider. Additionally, bundling can lead to discounts and special offers that are exclusive to bundled insurance packages.

How Does Bundling Insurance with USAA Work?

Bundling insurance policies with USAA is a straightforward process. Customers can contact USAA to discuss their insurance needs and explore options for bundling different policies together. By combining policies, customers can often save money compared to purchasing individual policies separately.

Cost Savings of Bundling vs. Individual Policies

When comparing the cost savings of bundling insurance with USAA versus purchasing individual policies, customers can typically expect to receive discounts or reduced premiums for bundled packages. These savings can vary depending on the types of policies being bundled.

Requirements for Bundling Insurance with USAA

While specific requirements may vary, customers generally need to have multiple eligible policies to qualify for bundled insurance with USAA. It’s advisable to consult with a USAA representative to determine eligibility and explore the best bundling options available.

What Types of Insurance Can Be Bundled with USAA?

USAA offers a range of insurance products, including auto, home, renters, life, and more. Typically, auto and home insurance are commonly bundled together, but customers can inquire about bundling other types of insurance based on their needs.

Limitations on Bundling Certain Types of Insurance

While many types of insurance can be bundled with USAA, there may be limitations or exclusions on bundling certain policies. Customers should check with USAA to understand which insurance products are eligible for bundling and any restrictions that may apply.

Discounts and Special Offers for Bundling Insurance with USAA

Customers who bundle insurance policies with USAA may be eligible for discounts and special offers. These incentives can include reduced premiums, multi-policy discounts, or promotions that are specific to bundled insurance packages. By bundling insurance, customers can potentially save money in the long run.

Final Thoughts

In conclusion, bundling insurance with USAA can lead to long-term savings and streamlined coverage. Consider bundling your insurance policies today to enjoy these benefits and more.

Question Bank

What types of insurance can be bundled with USAA?

USAA offers a variety of insurance products that can be bundled, such as auto, home, and life insurance.

Are there any discounts or special offers for bundling insurance with USAA?

USAA provides potential discounts and special promotions for policyholders who bundle their insurance policies, leading to cost savings in the long run.