Humana Medicare Supplement Insurance Plans set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. Exploring the benefits, coverage options, and more, this guide is designed to provide a clear understanding of what Humana has to offer.

Overview of Humana Medicare Supplement Insurance Plans

Humana Medicare Supplement Insurance Plans provide additional coverage to fill the gaps left by Original Medicare. These plans are offered by private insurance companies like Humana and are designed to help with out-of-pocket costs such as copayments, deductibles, and coinsurance. By choosing Humana over other providers, individuals can benefit from a wide range of coverage options, competitive pricing, and access to a large network of healthcare providers.

Types of Humana Medicare Supplement Insurance Plans

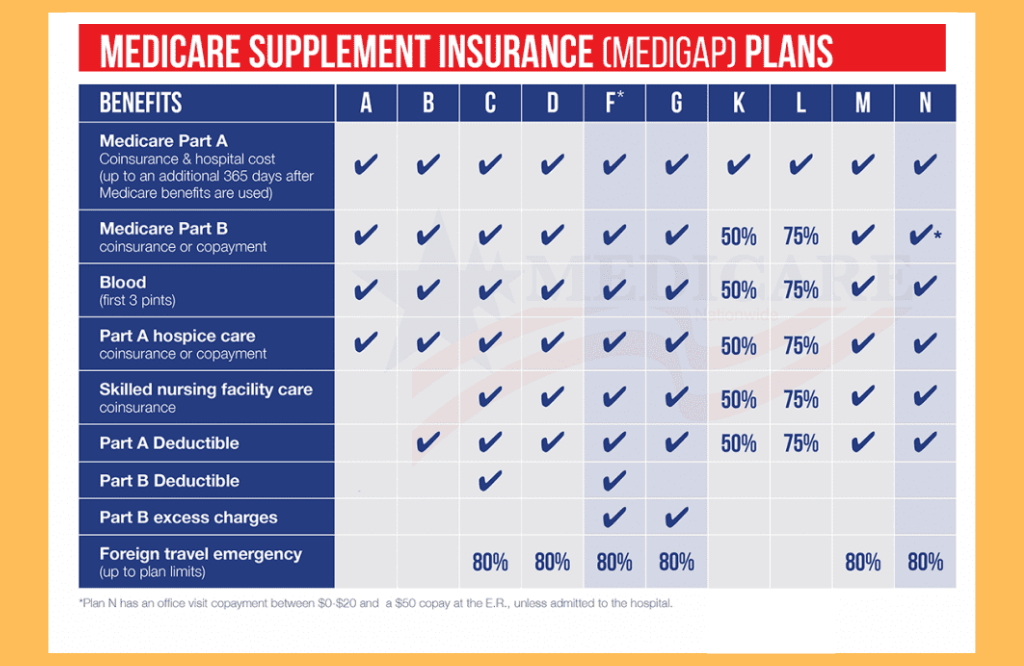

Humana offers various types of Medicare Supplement plans, including Plan A, Plan B, Plan C, Plan F, and Plan G. Each plan provides different levels of coverage, with Plan F being the most comprehensive. By comparing and contrasting the coverage and costs of each plan, individuals can choose the one that best suits their healthcare needs and budget.

Enrollment Process for Humana Medicare Supplement Insurance Plans

The enrollment process for Humana Medicare Supplement Insurance Plans involves filling out an application form, providing information about your current healthcare coverage, and selecting the plan that meets your needs. Eligibility criteria for signing up may vary, but generally, individuals must be enrolled in Original Medicare Part A and Part B. It is important to be aware of any deadlines or important dates during the enrollment period to ensure seamless coverage.

Cost and Pricing Structure of Humana Medicare Supplement Insurance Plans

The costs associated with Humana Medicare Supplement plans include premiums, deductibles, and copayments. Pricing varies based on the chosen plan and coverage level, with more comprehensive plans typically having higher premiums. To manage and reduce costs, individuals can explore options such as choosing a plan with lower coverage or taking advantage of discounts offered by Humana.

Provider Network and Coverage Area, Humana medicare supplement insurance plans

Humana Medicare Supplement Insurance Plans come with a wide network of healthcare providers and facilities that accept the coverage. It is essential to check the coverage area or regions where Humana plans are available to ensure access to care when needed. Some restrictions or limitations may apply when accessing care within the Humana network, so it is important to be aware of these details before enrolling in a plan.

Outcome Summary: Humana Medicare Supplement Insurance Plans

In conclusion, Humana Medicare Supplement Insurance Plans stand out as a reliable option for those seeking comprehensive coverage and cost-effective solutions. With a focus on quality care and a wide network of providers, choosing Humana can provide peace of mind for your healthcare needs.

General Inquiries

What makes Humana Medicare Supplement Insurance Plans unique?

Humana stands out for its diverse coverage options, competitive pricing, and extensive provider network, making it a top choice for many.

Are there any restrictions on accessing care within the Humana network?

While Humana offers a wide network, it’s essential to check for any specific restrictions or limitations in your area before enrolling.

How can I reduce costs when opting for Humana Medicare Supplement Insurance Plans?

Managing costs with Humana involves understanding your plan, utilizing in-network providers, and exploring potential discounts or wellness programs.