Delving into USAA bundle insurance, this introduction immerses readers in a unique and compelling narrative. Exploring the advantages of bundling insurance policies with USAA, customers can unlock a world of benefits and savings while streamlining their insurance management process.

As we delve deeper into the realm of USAA bundle insurance, we uncover a plethora of options and considerations that can significantly impact your insurance experience.

Benefits of USAA Bundle Insurance

When customers choose to bundle their insurance policies with USAA, they can enjoy a range of benefits. Bundling insurance policies can lead to cost savings and discounts, simplifying the insurance management process for customers. For example, customers who bundle their auto and home insurance policies with USAA can receive a discount on both policies, resulting in overall savings. By consolidating their insurance policies with one provider, customers can also streamline the payment process and have a single point of contact for their insurance needs.

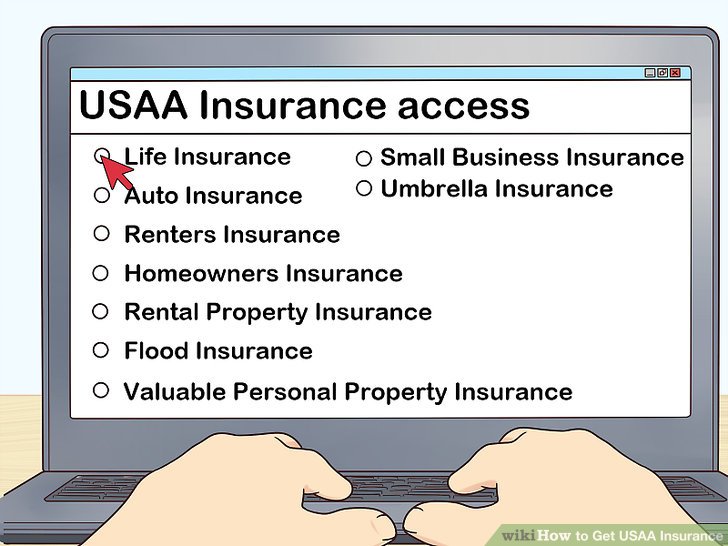

Types of Insurance Offered by USAA for Bundling

USAA offers a variety of insurance policies that customers can bundle, including auto, home, renters, life, and umbrella insurance. Each type of insurance comes with its coverage options, allowing customers to customize their insurance bundles based on their specific needs. For example, customers can create a bundle that includes auto and home insurance for comprehensive coverage or combine renters and life insurance for added protection.

Customer Experience with USAA Bundle Insurance

Customers who have bundled their insurance with USAA have reported positive experiences with the process. Setting up and managing bundled insurance policies with USAA is straightforward and convenient, with online tools and resources available to assist customers along the way. Additionally, USAA provides excellent customer support for bundled insurance customers, offering assistance with claims, policy changes, and any other insurance-related inquiries.

Considerations Before Bundling Insurance with USAA

Before deciding to bundle their insurance policies with USAA, customers should consider several factors. It’s essential to review the coverage options and discounts available for bundling, ensuring that the bundled policies meet their insurance needs. Customers should also compare the cost of bundling with USAA to individual policies from other providers to determine the most cost-effective option. Additionally, customers should be aware of any potential drawbacks or limitations of bundling insurance with USAA, such as restrictions on coverage or eligibility requirements.

Closing Notes

In conclusion, USAA bundle insurance offers a comprehensive solution for customers looking to simplify their insurance needs while enjoying potential discounts and personalized bundles. By understanding the various aspects of bundling with USAA, customers can make informed decisions that align with their unique requirements.

FAQ Guide: Usaa Bundle Insurance

What are the key benefits of bundling insurance policies with USAA?

By bundling insurance policies with USAA, customers can enjoy discounts, cost savings, and simplified insurance management.

What types of insurance does USAA offer for bundling?

USAA offers various insurance policies for bundling, including auto, home, and life insurance.

How do customers rate their experience with USAA bundle insurance?

Customers have provided positive testimonials about the ease of setting up and managing bundled insurance policies with USAA.

What factors should customers consider before bundling insurance with USAA?

Customers should consider factors like coverage options, customized bundles, and potential drawbacks before deciding to bundle with USAA.